Most great companies have originated and been established in the United States of America. Even though they started as small ventures, they eventually became leaders in their fields. However, the world of business is not as transparent as we think. A large company might have been established in the US, but that doesn’t mean it will be forever based there. Many of these brands will surprise you. Brands like IBM, Apple, Starbucks, Ben&Jerry’s, Holyday Inn have allowed foreign investors in their companies. Quite frankly, they needed it. If they didn’t come around at the right time, these companies might no longer be around by now.

These Good Ol’ American Companies Are No Longer Owned By Americans

General Electric

General Electric started in 1982 as a small brand. Since then, the company has grown at an exponential rate. It is currently involved in a variety of different sectors, ranging from healthcare to aviation to venture capital to electricity. This is one of those companies that seems extremely American, due in part to the “Made in America” label on the goods. But, in reality, it has been owned by a Chinese firm named Haier since 2016. GE was acquired for $5.4 billion, which is certainly on the upper end of the scale. Even though the goods are still manufactured in the United States, the final choices are made in China.

General Electric

AMC

This business established a reputation for itself in this sector and eventually grew to become the world’s largest movie theater chain. AMC theaters have been providing moviegoers with relaxed and enjoyable moviegoing experiences for almost a century. AMC stood for American Multi-Cinema. However, the main shareholder from 2012 to 2018 was a Chinese business named Dalian Wanda Group. This wasn’t how they originated but everything changed in 2018 when Silver Lake Partners purchased a $600 million interest in it. Despite this, Wanda Group continues to have the last say on executive-level decisions.

AMC

Budweiser

Some people believe that when it comes to beers, it doesn’t get much more American than this. It may have been true in the past, but even though it was established in Missouri and still says “America” on the container, this is no longer an American business. This business was purchased for $52 billion in 2008 by InBev, a Belgian beer giant. It may have American history, but we can’t claim the same for its future. In any case, we are relieved that the parent firm did not alter the recipe. It tastes just as it used to!

Budweiser

Ben & Jerry’s

Over the years, this ice cream business has become a pop-culture icon. Ben & Jerry’s has been referenced many times in TV programs and movies as one of the most adored foods in the United States. Jerry Greenfield and Ben Cohen, two closest friends, started it as an ice cream shop in Vermont in 1978. Things changed in 2000 when Unilever paid $326 million for the company. The London-based multinational outbid three other businesses interested in acquiring the ice cream company. This turned out to be a fantastic bargain since the choice benefited Unilever’s portfolio.

Ben & Jerry’s

Burger King

When most people think of fast food, they think of the United States. There are several indigenous chains, and Burger King is one among them. In 1954, David Egerton and James McLamore established the first “Insta Burger King” location in Miami. They had no idea it would grow into a worldwide brand. A decade later, they sold the business for the first time. It has subsequently been owned by several different people. It is now owned by Restaurant Brands International, a Canadian corporation. 3G Capital of New York City continues to provide financial support to BK.

Burger King

Trader Joe’s

When it comes to the convenience store industry, competition has always been intense. This is especially true in more densely populated areas. In 1967, a guy named Joe Coulombe started stocking unique and rare food products to persuade consumers to abandon 7-Eleven and instead visit his shop in Monrovia, California. His strategy was successful. Despite becoming a household name, he sold the business in 1979. It is currently owned by Theo Albrecht, who also controls the massive German grocery chain, Aldi Nord. He hails from a rich family and is estimated to be worth more than $16 billion! Whoa.

Trader Joe’s

Lucky Strike

Lucky Strike, commonly known as Luckies, seems to be the most popular American cigarette brand. People smoked the stuff in the 1930s and 1940s because it had such a great marketing strategy. This is why the brand was the best-selling cigarette brand at the time. In 1976, the firm began doing business with a company named British American Tobacco. The British business bought the American Tobacco Company and its subsidiaries, Lucky Strike and Pall Mall, in 1994. Even though it has undergone a lot of modifications, it is still regarded as a distinctively American brand. This may be due to its popularity in popular culture. Mad Men made extensive use of the brand!

Lucky Strike

American Apparel

People were attracted to American Apparel in part because of its “Made in the USA – Sweatshop-free” tagline. It was a brilliant concept to encourage ethical consumers to support the LA brand. The business was performing extremely well until 2015 when it began to struggle to get back on track. Two years later, a Canadian firm named Gildan Activewear rescued it by paying $88 million for the rights to its brand and manufacturing equipment. We doubt that American Apparel would be existing today if this had not occurred. To be more specific, the brand is still officially headquartered in the Americas.

American Apparel

7-Eleven

Every great business in the world began with a single individual who had a dream. This also applied to 7-Eleven. Jefferson Green was a regular Joe working at Southland Ice in 1927 when he decided to expand his product line. He began to provide bread, eggs, and milk as well. It proved to be a successful business strategy, and his Dallas-based company grew, even more, when he renamed it 7-Eleven after its retail hours. Decades later, it has been ingrained in American society. It did, however, have a difficult patch during the 1987 financial collapse. This is when Ito-Yokado, a Japanese firm, stepped in to assist. This is why it has become a subsidiary of Seven & I Holdings.

7 Eleven

Sunglass Hut

Sunglass Hut is the finest location to shop for many American eyewear enthusiasts. From tinted shades to clear spectacles, the business has everything you could need. It has operations in South Africa, India, the United Kingdom, and other countries. Despite this, the business was founded in Miami, Florida by an optometrist by the name of Sanford Ziff. The business was sold five years after it opened its 100th site in 1986. Luxottica purchased it for $653 million in 2001. There were about 1,300 shops in operation at the time. At the present, there are almost 2,000 shops worldwide!

Sunglass Hut

Motorola

Motorola, well known for its technology products, was founded in Schaumburg, Illinois long before the idea of mobile phones was ever conceived. After its first debut in 1928, it saw continuous growth until it reached its pinnacle of popularity with flip phones and the like. Google ultimately purchased it, only to sell it in 2014 to a Chinese firm named Lenovo. This was not a lucrative move for Google since it purchased the business for $12 billion two years before selling it for $2.9 billion. People are still perplexed as to why Google appeared content to lose $10 billion on this transaction.

Motorola

Ironman

The Hawaii Triathlon Corporation launched the Ironmen race. Dr. James P. Gills purchased it for $3 million in 1990. It has subsequently grown into a much larger organization than it was at the outset. Providence Equity Securities paid $85 million for the business in 2008. Seven years later, the Dalian Wanda Group purchased it for $650 million! It turns out that the Chinese firm had to assume the prior owner’s debt to do so. Wanda was overjoyed with the 40 percent year after year net increase that it experienced, although it had been successful before the present arrangement.

Ironman

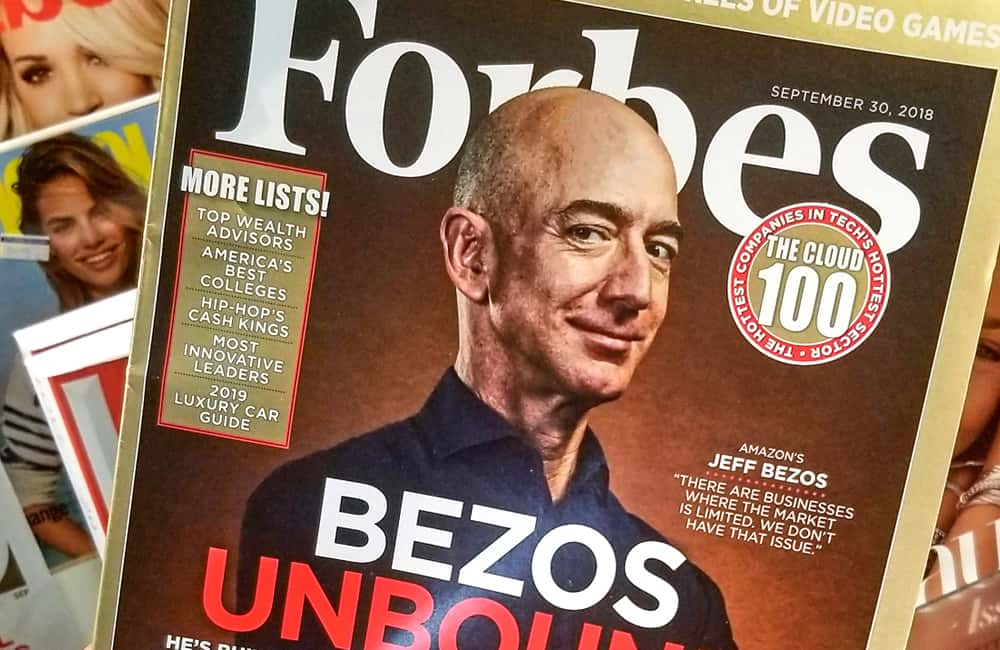

Forbes

Forbes published its debut edition in September 1917. Isn’t it amazing that it’s been 103 years since then? It has subsequently become a well-known publication that publishes comprehensive and dependable rankings of celebrities and businesses. We’re sure you’ve heard of its famous lists like the World’s 100 Most Powerful Women and 30 Under 30. Although many people believe it is an American magazine, it is currently owned by a Hong Kong-based firm named Integrated Whale Media Investments. Forbes was acquired for $400 million in 2014. However, we doubt that the readers observed any differences before and after the agreement was struck.

Forbes

Dirt Devil

Dirt Devil vacuum cleaners have been keeping American homes clean for almost a century. Philip Geier developed the product in Cleveland, Ohio in 1905. Since then, the product line has grown to include more than 25 million units sold. This is mainly due to the one-of-a-kind Cyclone system. Even though its headquarters remain in North Carolina, the business is proudly owned by a Chinese corporation named Techtronic Industries. Dirt Devil isn’t its only home appliance brand; it also owns Hoover, which it acquired a few years ago. We are certain that these choices have aided the HK-based company’s appliance investment portfolio!

Dirt Devil

Good Humor

Good Humor ice cream is very popular among baby boomers. The firm, which has been in business for almost a century, is best known for its ice cream trucks. It was founded in Ohio in the 1920s and hasn’t looked back since! Unilever’s Thomas J. Lipton purchased the business in 1961. Even while Lipton currently runs the British-Dutch company’s US business, we can’t dispute that things have only gotten better for Good Humor since then. After all, the company has subsequently extended its product line to cover a broader range of items while maintaining a strong customer base in the nation.

Good Humor

Popsicle

Wait till you hear this company’s interesting history! An 11-year-old kid from Oakland, California developed the Popsicle recipe after inadvertently leaving his drink outdoors with a stick in it for the whole night. When he went to get it the next day, it was frozen solid! When Francis Epperson grew up, he shared it with the rest of the world. It was an immediate success, and he sold the rights to Joe Lowe in 1925. He later regretted his choice, saying, “I haven’t been the same since.” Popsicle was acquired by its erstwhile competitor firm Good Humor in 1989 when it was a part of Unilever. This effectively implies that it is now also owned by the same English-Dutch parent corporation.

Popsicle

Purina

Purina started in 1894 when George Robinson, William H. Danforth, and William Andrews began feeding farm animals. They had no clue that their invention would make them very wealthy. Nestle is more known for its food than its pet goods. The Swiss firm purchased Purina for $10.3 billion in December 2011. This decision was made as part of a proposal to combine Purina with Friskies PetCare, the company’s pet food division. In any case, Purina remains a household staple not just in the United States, but all around the globe.

Purina

Firestone

The tire manufacturer Firestone was given the chance to combine with an Italian firm named Pirelli. The agreement, however, did not sit well with everyone. This is why Firestone instead decided to sell to a Japanese firm named Bridgestone Corp. The Tokyo-based company paid $2.6 million for it, equating to $80 per share. Bridgestone is now the country’s second-largest tire producer as a result of this decision. According to a Firestone spokesperson, “the Bridgestone offer meets our goal of increasing shareholder values and will contribute significantly to the job stability and development possibilities available to the men and women employed by Firestone’s current companies.”

Firestone

Gerber

Nestle stated in 2007 that it intended to pay $5.5 billion for Gerber Products Company. It was the correct decision since it meant that the Swiss firm now held the largest share of the infant food market. It is a highly lucrative market. The baby food store has been in business since 1927 when Daniel Frank Gerber’s wife started cooking baby food for their daughter Sally. He considered selling the product, and they quickly presented five distinct items to the market. The business has gone a long way from its modest beginnings in New Jersey!

Gerber

Citgo

Citgo, which was founded in Oklahoma in 1910, grew to become a major trader and refiner of fuels and other commodities. Petróleos de Venezuela, a Venezuelan business, acquired half of it in 1986 and became its parent firm. Unfortunately, things haven’t been going so well for it. President Hugo Chavez told the world that he intended to do rid of Citgo, citing “poor business” that led to declining earnings. The sale did not take place because they sold bonds instead. The South American country was in the grip of a severe economic downturn in 2013. It was given as loan collateral to Russia, but the future is unclear.

Citgo

IBM (PC Division)

Since its inception at IBM, this business has helped the United States maintain its technological leadership. Back then, it was more concerned with business machinery than computers. To say the least, IBM has a very interesting history. Lenovo paid $1.75 billion to acquire its PC business in 2004. “As Lenovo’s founder, I am delighted about this milestone in Lenovo’s path to become a worldwide business,” said Chuanzhi Liu, Lenovo’s CEO at the time. In contrast, IBM CEO Sam Palmisano said, “Today’s news further enhances IBM’s capacity to seize the highest-value opportunities in a fast-evolving information technology market.”

IBM (PC Division)

Legendary Entertainment Group

Dalian Wanda Group chose to go all-in by purchasing a movie studio in 2016 after purchasing AMC and seeing tremendous success in the movie business. Legendary Entertainment Group agreed to sell its stake in the Chinese business for $3.5 billion. Dalian Wanda Group intended to include it into its current portfolio at the moment. However, it ultimately decided to keep things as they were. Let’s take a look at how things are going for LEG four years after the acquisition. It has produced films like Jurassic World: Fallen Kingdom, Pacific Rim: Uprising, Kong: Skull Island, and Skyscraper after its purchase.

Legendary Entertainment Group

Hoover US

Hoover has established itself as a recognized American appliance brand when it first opened its doors in 1908. The business, named after its founder, William Henry Hoover, has become an iconic brand. Even though things were mostly local for a long time, things began to change when Techtronic Industries purchased it for $107 million in 2006. The headquarters are still in North Carolina, but the central office is now in Hong Kong. The Chinese business is massive, with over 30,000 employees and annual revenues of more than $7.7 billion. While it is no longer a wholly-owned American corporation, it is in excellent hands.

Hoover US

Frigidaire

Frigidaire, formerly known as the Guardian Frigerator Company, was founded in Indiana in 1918. While Alfred Mellowes and Nathaniel B. Wales had the concept, they did not have the money to get it started. This is where General Motors’ William C. Durant comes in! He invested in the business, allowing the pair to grow it to where it is today. In 1979, it was owned by the White Sewing Machine Company. However, it was purchased in 1986 by a Swedish firm named Electrolux. Frigidaire is a part of this business to this day, but it seems to be doing well.

Frigidaire

Strategic Hotels And Resorts

This hotel chain presently operates 17 luxury hotels in the United States as well as one in Germany. Strategic Hotels and Resorts was founded in 1997. Laurence S. Geller, a philanthropist, and real estate investor came up with the idea. In 2016, Anbang Insurance Group, a Chinese business, was said to be interested in purchasing it for $6.5 million. However, it seems that the agreement was renegotiated in the end, since the insurance firm purchased the hotel chain for $1 million less. This was because one of the properties could not be sold. Because it was near to a naval installation, the US government prohibited it from proceeding.

Strategic Hotels And Resorts

Alka-Seltzer

Alka-Seltzer is one of the world’s oldest branded medications. Dr. Miles Medicine Company, now known as Miles Laboratories, began selling this pain reliever and antacid drink in 1931. While it had been in American hands for a long time, it was purchased by a German firm called Bayer in 1978. Bayer has a reputation for rubbing elbows with the world’s top pharmaceutical firms. In 2004, it even reached an agreement with GlaxoSmithKline to work on a combined effort to increase Levitra sales via the usage of the “Strike Up A Conversation” tag line.

Alka-Seltzer

The Chrysler Building

Many people were taken aback in 2019 when The Wall Street Journal published an article regarding the sale of the Chrysler Building. After all, this was one of the most recognizable buildings in the New York skyline. However, it has not been in the hands of an American for quite some time. The Abu Dhabi Investment Council purchased a controlling stake in the company in 2008 for $800 million. A decade later, it was purchased for more than $150 million by an Austrian firm named SIGNA. When the news broke, it was seen as a massive loss that made headlines in different financial publications across the globe.

The Chrysler Building

General Motors

Did you know General Motors is the biggest car manufacturer in the United States? It is one of the world’s biggest businesses in the sector, therefore it is a highly attractive and lucrative company. Even though it is not entirely controlled by Shanghai Automotive Industry Corp, it is nonetheless financially dependent on the Chinese business. In 1998, the two businesses formed a joint venture. Customers may not realize it, but SAIC sells vehicles under the General Motors brand. In any case, they are two distinct businesses, with the SAIC headquarters in Shanghai and the GM headquarters in Detroit.

General Motors

Spotify

It’s difficult for us to picture a period when we couldn’t listen to our favorite music with the click of a button. We are very grateful to Spotify for making this happen! The New York-based business was established in 2006 and quickly gained renown for allowing users to stream music. While it originated in Sweden, it has subsequently migrated to many other nations. Spotify and Tencent Holdings each acquired a 10% interest in the other in 2017. The joint venture was successful in assisting Spotify’s entry into the Chinese market and allowing Tencent to grow its portfolio even further. Before this collaboration, the streaming business struggled to expand its position in the Chinese market.

Spotify

The Waldorf Astoria Hotel

The Waldorf Astoria Hotel is an excellent option for premium lodging. It is not just a New York institution, but it is also a part of American history. While Hilton Worldwide operates the property, Anbang Insurance Group purchased it in 2014 for $1.95 billion. With this outrageous fee, it is the most expensive hotel in history. The Chinese firm made significant modifications to the hotel, converting a portion of its rooms into condominiums. The insurance firm is also interested in acquiring additional American companies. Starwood Resorts was one of the properties it was considering.

The Waldorf Astoria Hotel

Tesla

Elon Musk, the man behind Tesla, is the business’s largest stakeholder, owning 21.7 percent of the corporation. Aside from him, the business has a large number of owners, including Tencent Holdings Ltd. It turns out that the Chinese business is interested in a variety of topics, not only music. Tencent is also the world’s largest video gaming business and one of the largest social media companies. It even had a net income of $95.8 billion in 2019. Whatever they are doing, it is obvious that they are doing it correctly! We are certain that it will continue to expand in the future.

Tesla

Snapchat

We doubt that the trend of applying funny filters on our pictures would have occurred without Snapchat. Bobby Murphy and Evan Spiegel created the app in 2011 with no clue how popular it would become. Snapchat is now valued at more than $20 billion. Tencent, a Chinese corporation, was able to expand its reach to Snapchat in 2017. This computer behemoth spent more than $2 billion for a 10% share in the social media business in the hopes of making a tidy profit. Aside from that, Tencent assisted Snapchat in creating augmented reality capabilities by using its technological skills.

Snapchat

Ingram Micro

Ingram Micro began as a small electronics goods reseller in 1979. After then, it was able to grow into a multibillion-dollar corporation! It was able to acquire Softinvest, a Belgian firm, in the early 1990s. This deal allowed Ingram to distribute HP goods and establish a stronger market position. Tianjin Tianhai Investment, a Chinese firm owned by the HNA Group, purchased Ingram for $6 billion in 2016. This made it one of the parent company’s top earners across the board. On the other side, this increased Ingram’s worldwide presence.

Ingram Micro

Fidelity & Guaranty Life

Since its inception in 1959 in Des Moines, Illinois, Fidelity and Guaranty Life Insurance Company has helped millions of people safeguard their future. Having said that, its future had not been all that certain. It was formerly owned by Harbinger Group, but the parent company made it available to the public in 2013. Anbang Insurance Group was interested and paid $1.57 billion for F&G. Everything seemed to be going smoothly until the Chinese firm canceled the contract at the last minute. Following an unexpected change of plans, CF Corp purchased F&G in 2017 for about $1.84 billion.

Fidelity & Guaranty Life

Universal Music Group

Any aspiring musician would be thrilled to get a record contract with Universal Music Group. Along with Warner Music Group and Sony Music, it is one of the “Big Three” record labels. UMG has been in the business for almost a century. It has aided in the development of many domestic artists, but the reality is that it is no longer a completely American business. For more than a decade, Vivendi had the controlling interest, but it finally agreed to a transaction with Tencent in 2020. The Shenzhen-based business paid $33.4 billion for a 10% stake in the record label.

Universal Music Group

WeWork

We’re sure you’ve seen the growth of shared workplaces in recent years. This arrangement is appealing to freelancers and entrepreneurs. WeWork capitalized on this when it first started a decade ago. It currently handles almost 4 million square meters of space! However, it went through a difficult period in 2016 and required more cash. That’s when Legend Holdings Corp., headquartered in Beijing, became a “new partner” and invested more than $430 million in the business. Legend Holdings Corp.’s John Zhao went so far as to add, “Our investment in WeWork is both strategic and clear.”

WeWork

Segway Inc

People would have thought that zipping about on two wheels was something out of a science fiction movie a few decades ago. Segway Inc. has shown that this is also possible in real life. In 2015, a Beijing-based firm named Ninebot paid $80 million for the transportation company. Segway’s fortunes have only improved since then, thanks to the Chinese company’s assistance in gaining a stronger footing in the worlds of technology and robotics. In 2018, the business revealed plans to relocate its manufacturing sector from New Hampshire to China. However, it then reversed its decision, stating that the bulk of production will stay in Bedford.

Segway Inc

John Hancock Life Insurance

Under the John Hancock Financial Opportunities label, a wide range of products are available. It is no secret, however, that the business is best known for its life insurance products. It has been in business since 1862 when it was established in Boston. However, in 2004, it was purchased by Manulife Financial, a Canadian corporation. The new parent firm could easily absorb the John Hancock brand, it decided to retain it under its old identity. Manulife Financial is headquartered in Toronto, employs over 34,000 people, and has 63,000 agents working for the company.

John Hancock Life Insurance

Sotheby’s

It may surprise you to learn that a Chinese life insurance firm has a stake in a premium art dealer. Sotheby’s was founded in London in 1744. However, it ultimately established a store in New York City before expanding to other parts of the world. Taikang Life Insurance Co. Ltd., a Chinese business, announced in 2016 that it is the new majority stakeholder of Sotheby’s. It remained that way until a French-Israeli billionaire named Patrick Drahi purchased Sotheby’s in 2019. However, we do not know what will happen to the Chinese insurance group’s 13.5 percent share in the business.

Sotheby’s

The Barclays Center

The famous Barclays Center will be recognizable to any sports enthusiast or music aficionado. In 2019, Joseph Tsai, a Taiwanese-Canadian business tycoon, completed the acquisition of this famous theater. Aside from that, the Alibaba Group chairman bought the NBA’s Brooklyn Nets. Tsai said at the time, “With full ownership of the Nets and Barclays Center, we will continue to deliver our entertaining style of basketball to our fans.” “We’ve made a significant commitment to Brooklyn,” he said, “and it will be a pleasure to showcase the finest of Barclays Center with its outstanding entertainment to our neighborhood.”

The Barclays Center

Brookstone Inc

Brookstone Inc. began as a mail-order company selling unique and uncommon tools in the mid-1960s. After a while, it began to offer a variety of goods such as alarm clocks, remote control toys, and other items. It has 34 locations in the United States by 2018. However, in 2014, it had financial difficulties and even declared bankruptcy. It was fortunate that Chinese firms Sanpower and Sailing Capital saved it by buying it for $173 million. We are grateful that they intervened at the appropriate moment, preventing Brookstone from going bankrupt. People were relieved when the business was able to emerge from bankruptcy a few months later, in July 2014.

Brookstone Inc

Dairy Farmers of America Inc

Who would have guessed that a business with the name Dairy Farmers of America would be connected with China? It may seem implausible, but it is true! Inner Mongolia Yili Industrial Group partnered with DFA in 2014 to create milk powder at a new processing facility. It occurred about the same time when China was unable to supply milk due to a drought in New Zealand. This meant that the country’s supply was cut off. Inner Mongolia Yili Industrial Group increased its worldwide footprint in an attempt to address the issue. It does not own DFA, the two are bedfellows.

Dairy Farmers Of America Inc

Fab.com Inc

The fact is that every company in the internet design sector confronts significant competition. Fab.com Inc was formerly headquartered in New York, but it has recently received a billion-dollar investment from Tencent Holdings. Fab previously said that it wanted to enter the Asian market. “It’s a method of entering markets via strategic partners who can assist reduce risk and improve the probability of success,” CEO Jason Goldberg said. In 2015, a firm named PCH International purchased the business two years later. Following this, it was relaunched as a health company that focuses on yoga gear.

Fab.com Inc

The Cleveland Cavaliers

With the assistance of sponsors, the NBA franchise joined the league in 1970. The Cleveland Cavaliers continued to flourish in the decades that followed. It got support from the Goodyear Tire and Rubber Company, among others. However, in 2019, they began to attract foreign investors as well. The Cavs collaborated with Jianhua, a Chinese billionaire who had previously worked with the New York Yankees and other American sports organizations. According to reports, he bought a 15% interest in the NBA club. It is not uncommon for sports clubs to get funding from overseas sources, so there is no reason to be surprised. This is also why LeBron James has such a large fan base in China!

The Cleveland Cavaliers

Riot Games Inc

Riot Games is well-known to fans of the multiplayer online gaming sensation League of Legends. The game, which was released in 2009, quickly gained a huge fanbase and became the company’s most well-known product. Riot Games has been working with Tencent for a long time, their collaboration peaked in 2015. The Chinese firm bought the remaining interests and became Riot Games’ parent company. It already controlled 93 percent of the gaming business before this. With this in mind, we get the sense that the latest development was already a foregone conclusion. Riot Games is estimated to be worth $6 billion.

Riot Games Inc

Uber Technologies Inc

We can’t fathom life without Uber! The software allows users to hail a ride with the touch of a button. In 2009, Travis Kalanick and Garrett Camp came up with the concept. Since then, it has come a long way! It is now a multibillion-dollar corporation that is well-known not just in the United States but also in other areas of the world. In 214, Baidu Inc., a Chinese internet firm, spent more than $600 million in the aim of assisting its growth into China. It was a win-win situation since it enabled Baidu to utilize the app to expand its own mobile payment business. We are relieved that everything worked out!

Uber Technologies Inc

OmniVision Technologies Inc

OmniVision Technologies Inc. and Will Semiconductor Co. Ltd formed a collaboration so discreetly that the public was unaware of it until a year later. When the news surfaced in April 2019, they had already completed deals totaling more than $2.1 billion. We don’t know a lot of the specifics around the transaction since they kept it so low-key. However, we do know that OmniVision initially approached Chinese investors in 2015. This was about the time that two Chinese firms joined together to buy the California-based company for $1.9 billion. People are still perplexed as to why an unknown Chinese firm, such as Will Semiconductor Co. Ltd chose to take over the company.

OmniVision Technologies Inc

Baby Trend Inc

This baby goods business, based in Fontana, California, sells everything from car seats to high chairs to diaper pails. It expanded throughout time, particularly when it was acquired by a Chinese firm named Alpha Group. “We are thrilled to be able to provide safe, educational, and amusing solutions to babies and their caretakers all around the globe,” Alpha Group Vice President Wang Jing stated. “By acquiring Baby Trend, we will be able to integrate our unique technology and excellent intellectual assets into a whole new category while displaying our current experience in the worldwide baby and infant market.”

Baby Trend Inc

University of Texas MD Anderson Cancer Center

When a Beijing-based business named Concord Medical Services acquired a fifth of the University of Texas M.D. Anderson Cancer Center Proton Therapy Center in 2012, many people were perplexed. Even while it did not affect the university’s ownership holdings, it did raise the prominence of the Chinese business. “Proton therapy has become a widely recognized technique of radiation therapy,” Dr. Jianyu Yang said. He is Concord Medical’s medical chairman and CEO. “Concord Medical intends to construct and run two proton facilities in China.” This acquisition will provide us with significant expertise and understanding of proton treatment center operations from the global leader in proton therapy cancer care.”

University Of Texas MD Anderson Cancer Center